In this new series for ESG Clarity Asia, Morningstar will be diving into ESG funds available in Asia, analysing their investments, performance and ESG credentials.

For this first article, Morningstar’s Mara Dobrescu takes a look at the Pimco GIS Global Bond ESG fund.

This fund earns a Morningstar analyst rating of gold on its cheapest share classes, with more expensive ones earning silver and, respectively, bronze. It also has a Morningstar sustainability rating of four globes, which indicates that, compared to peers, the strategy has more of its assets invested in securities with lower ESG risk as characterised by Morningstar Sustainalytics.

It has been managed since its 2017 inception by Andrew Balls, forming a formidable trio with Sachin Gupta and Lorenzo Pagani, and although it bears many similarities to the non-ESG Pimco Global Bond strategy, we expect the managers to uphold higher standards of ESG in their investments.

They, and the vast investment group, are well-equipped to cover rates, currencies, corporates and structured credit. Over time, analysts have incorporated ESG factors more explicitly, maintaining high research standards along the way.

A light touch approach

On the one hand, the fund’s duration, country, and sector risks are similar to its non-ESG sibling and largely reflect Pimco’s top-down views. This ESG variant of the strategy, however, shows more differentiation within its corporate credit sleeve. Far more is held in green and sustainable development goal-linked bonds (around 20% of assets), and there’s much greater exposure to renewable energy utilities at the expense of businesses with a heavier carbon footprint such as oil producers and energy pipelines.

The portfolio’s corporate sustainability score, as calculated by Morningstar based on the fund’s most recent corporate bond holdings, thus indicates a lower ESG risk than the category average (which includes both sustainable and plain vanilla offerings).

Still, balancing positive ESG outcomes without compromising on investment conviction poses some challenges. This tension materialises in Pimco’s approach to sovereign bonds, a big chunk of the fund’s universe: ESG factors only affect a handful of emerging economies through exclusions and adjusted weights. This is also reflected in the fund’s sovereign sustainability score, which has historically been fairly close to the category average.

This light touch may not satisfy investors looking for a harder line approach, but the flip side is allowing mostly free rein to craft an optimal financial outcome via duration and country management. In recent years, however, Balls and his team have been more careful about plunging outsize bets when valuation opportunities are scant and when market visibility tends to be low, as is the case currently.

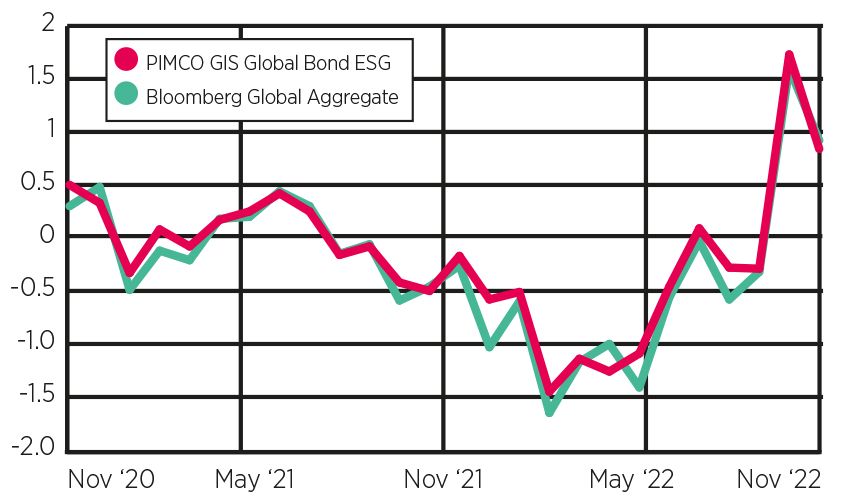

Over this team’s watch since 2017, the strategy has produced convincing returns, outpacing its average peer in the Morningstar Global Bond – USD Hedged category, while also keeping up with its non-ESG sibling. Overall, we expect the fund to continue to deliver incremental outperformance while maintaining its ESG credentials.

Pimco fund sticks close to Bloomberg benchmark