Schroders launches energy transition infrastructure LTAF

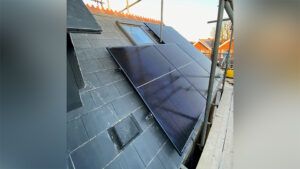

Schroders Greencoat, the renewables and energy transition infrastructure manager of Schroders Capital, has launched a long-term asset fund (LTAF) dedicated to renewable energy and energy transition infrastructure. The Schroders Greencoat Global Renewables+ LTAF is designed to allow UK pension savers to invest in this asset class while benefitting from “stable, diversifying and inflation-linked investment returns”. … Read more