Grupo SURA is a Latin American investment manager that develops a portfolio of leading companies in insurance, savings and investment, banking, infrastructure and food industries. With more than 77 years of history, it has been characterized as an organization with a philosophy that has integrated a commitment to human, social and environmental issues to the creation of economic value, by recognizing the role of companies in building sustainable societies.

Its subsidiaries, present in 10 Latin American countries, not only manage financial services and related businesses, but also seek to be increasingly relevant in the lives of more than 44 million people and companies that trust in the products, solutions and services provided by more than 30,000 employees of the subsidiaries Suramericana (insurance) and SURA Asset Management (savings and investment).

This creation of value is also demonstrated in relationships based on trust with different stakeholders, and the linking or promotion of various social, educational and cultural initiatives that promote human development and transform territories. And why?

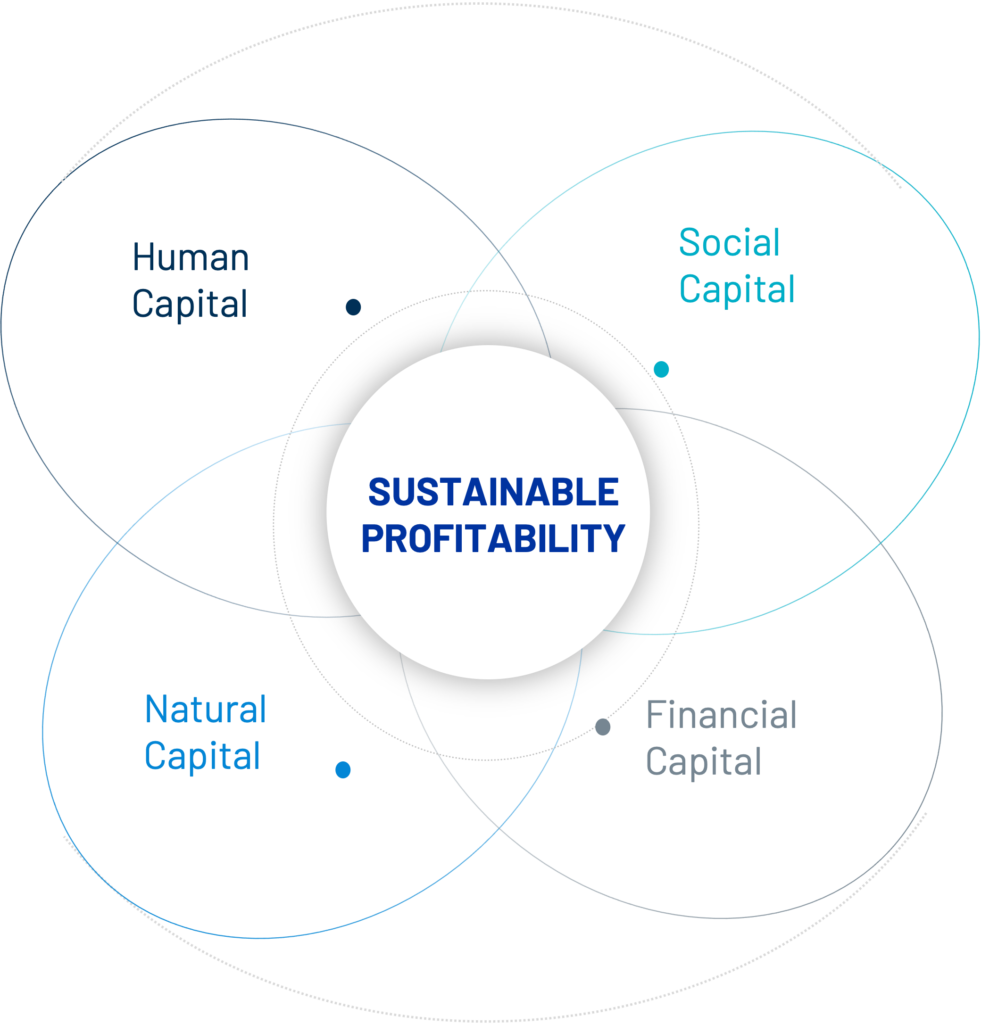

AN INTEGRATED VISION

Sustainable profitability is possible through the creation of economic value for shareholders and the contribution to a harmonious development, that is, a growth that maximizes the well- being of society. To achieve this, a balanced management of financial, human, social and natural capital (finite resources) is pursued.

Now, all organizations manage capitals, however, the real differentiator is when it occurs through a decision-making culture that considers the interrelations that exist between them, to achieve a balance.

A WELL-BALANCED HANDLING OF OUR FOUR CAPITAL FRAMEWORK

“We start from complex thinking and a long-term vision to be sustainable. And that is possible by managing financial resources to have a return higher than the cost of capital; by advancing in the inclusion of environmental criteria in investment decisions of portfolio companies; by the consideration of social issues in the development of products, solutions and services that close inequality gaps, in addition to the historical work of the Fundación SURA; and by enabling the development of skills not only of employees, but also of suppliers, insurance advisors, citizens and others. This is how we seek that our growth responds to these four capitals”, explained Gonzalo Pérez, president of Grupo SURA.

In this context, some entities have studied the concepts associated with different types of capitals and apply them in the analysis of risks and impacts of companies, to improve the way in which they are managed beyond financial resources. For example, the International Integrated Reporting Council (IIRC) proposed some time ago reporting principles based on the use of different capitals. For its part, the World Business Council for Sustainable Development (WBCSD) developed protocols that sought to improve companies’ understanding of the relationship and use they make of capitals, as well as the analysis of their interdependencies.

“WE START FROM COMPLEX THINKING AND A LONG- TERM VISION TO BE SUSTAINABLE AND THAT IS POSSIBLE BY MANAGING FINANCIAL RESOURCES TO HAVE A RETURN HIGHER THAN THE COST OF CAPITAL”

GONZALO PÉREZ, PRESIDENT OF GRUPO SURA

ESG AND CLIMATE CHANGE: A PRIORITY

In line with the foregoing, Grupo SURA has incorporated various criteria associated with human, social, environmental, and governance factors into management decision-making, through framework policies on issues such as sustainable investment, human rights, social investment, good governance, among others.

As a result, and considering the materiality analyses, one of the prioritized issues has been climate change. In this topic there is an action framework of guidelines to incorporate risks in the general management system, as well as selected scenarios for risk analysis. “We are working to quantify and minimize the impact of greenhouse gas emissions derived from the activities of the companies in our investment portfolio (financed emissions), as part of our natural capital approach,” added Lina Uribe, director of Sustainability of Grupo SURA.

Finally, the search for balanced capital management is not a finished task, it is a path of learning. Thus, a constant development of interdisciplinary knowledge is required, a permanent evaluation of risks and opportunities, as well as an integrated vision around interrelationships between these capitals, to mention a few aspects. In such manner, it is possible to guide decisions and strategic actions in terms of profitability that is combined with long-term sustainability.

SURA IN FIGURES

- Financial Capital: the company’s assets have grown more than 36 times in the last 20 years.

- Social Capital: nearly 800 thousand people improved their quality of life with SURA’s social investment in 10 countries in 2021.

- Human Capital: 14,879 suppliers of the SURA Business Group were trained in financial management and sustainability.

- Natural Capital: USD 986 million of assets under management invested by SURA Asset Management integrating ESG and carbon risk criteria, as well as an 82% growth in sustainable insurance premiums for Suramericana in the last year.