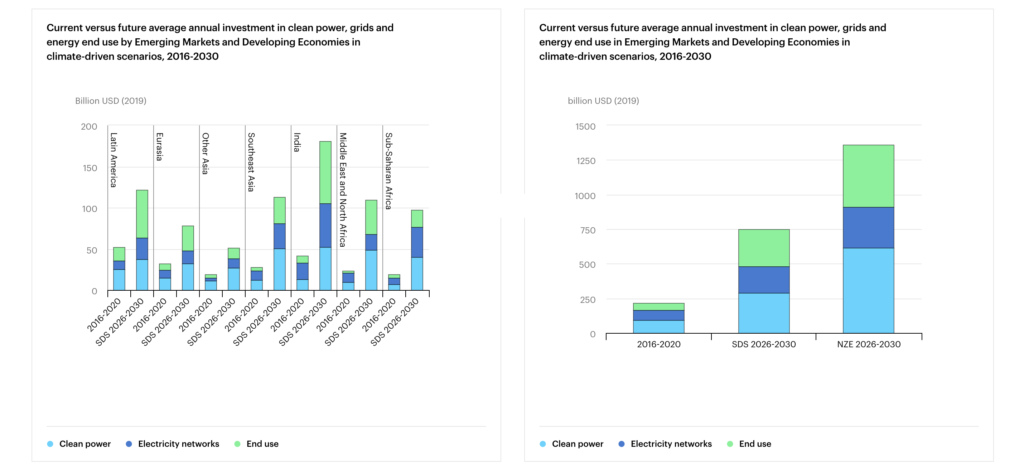

Investment in capital-intensive clean power and electricity networks, as well as spending on energy efficiency and electrification via greener buildings, appliances and EVs, would need to more than triple in EMDEs in the 2020s to be consistent with a well-below-2 °C temperature outcome (from about USD 45 per person in EMDEs today to around USD 130) and increase more than six times in order to keep the door open for a 1.5 °C stabilisation (to around USD 240 per person).

The power sector accounts for a rising share of total investment, as clean electricity and electrification need to play central roles in EMDE strategies for sustainable development. At least 1 600 GW of renewable capacity is added over the next decade in rapid transitions, increasing the share of renewables in total power installed capacity to well above half by 2030, from 30% today. This shift demands an increase of private capital with greater reliance on debt and project finance. Policies supportive of private-sector participation and competition, and targeted public finance have helped lower the cost of capital and attract private investment in renewable power, but stronger efforts are needed. In more mature EMDE markets, efforts focus on addressing persistent risks, such as access to long-term, locally denominated debt, while markets at earlier stages of development still require clear targets supported by regulation and a greater role of blended finance to help crowd in private capital.

Investment in electricity networks and battery storage has to grow rapidly to accommodate rising electricity demand and the surge in renewables deployment; in the SDS it nearly triples to USD 200 billion by the late 2020s, and rises even faster to USD 325 billion in the NZE. Financing – provided mainly by state-owned utility balance sheets – depends on good system planning and regulation. Development finance institutions can help to bolster funding options along with supporting investment in smarter, digitalised systems. In some markets, with enabling reforms, new business models to attract private financing for grids could help bridge the investment gap.

Generation and networks businesses are unbundled in most EMDEs, but states often own the utility companies that shape decision-making across electricity investments. While many utilities in EMDEs have improved cost recovery over time, the pandemic has exacerbated vulnerabilities and financial stresses, including their ability to invest in grids and act as creditworthy power purchasers. Better financial performance comes through reforms that boost competition, enhance planning and operations, promote cost-reflective tariffs, sound financial management and good governance.

Rapid urbanisation and strong construction activity in EMDEs puts a premium on investment in energy-efficient, digitally-connected buildings in climate driven-scenarios, alongside a step-change in spending on clean solutions to manage the huge rise in demand for cooling. Constrained access to affordable consumer finance, lack of building codes, split incentives, and energy subsidies all inhibit investment in green construction at the scale needed to meet climate-aligned scenarios. Stronger performance standards, building certification schemes and increased deployment of a range of financing solutions – including credit lines from development finance institutions and ESCOs – can help to overcome spending barriers.

Fast-growing mobility demands in EMDEs call for a roll-out of cleaner transport solutions, including public transit and new vehicle options. Passenger EV sales reach over 5 million in 2030 in the SDS from a very low base today, with capital increasingly reliant on better access to debt finance. High borrowing costs, underdeveloped manufacturing capacity and limited charging stations pose challenges to deployment. These can be bridged with tax incentives, purchase subsidies, expansion of green auto loans and leasing models. Efforts to roll out mass transit benefit from tapping into sustainable debt markets and partnerships with global technology providers.

Enabling universal access to electricity by 2030 requires investment of USD 35 billion per year, with half of that for decentralised solutions including USD 13.5 billion in sub-Saharan Africa. While debt fundraising has improved as some markets have become more attractive to lenders, public concessional funds continue to underpin investment, especially in countries with high risks or weak underlying economics. A similar story holds for clean cooking, where business models are still being explored.

www.iea.org